Forex, or Foreign Exchange Market, is also known as FX. Currency exchange occurs when one country's currency is replaced by the currency of another country. Individuals, banks, and multinational corporations, among others, trade forex, unlike stocks. Multibillions of dollars are exchanged on the Forex market every day.

Your Forex Trading Guide

Forex trade involves trading the world's currencies. There is a difference in the value of the currency of one country compared to the currency of another. Trading in the foreign exchange market allows you to earn money. In addition, profits can be made by buying certain currencies today at a low price and then selling them tomorrow or in the future at a higher price.

The following points are addressed in this topic:

What is Forex Exactly?

Speculating in the Forex market

Advantages of the Forex Market

Currency Symbols

Currencies Are Traded in Pairs

Understanding a Forex Quote

What Does “Pip” Mean?

Leverage

Technical Analysis

What is Forex Exactly?

You will want to choose those currencies that are moving against other currencies when trading the Forex market. British Pound, Euro, US Dollar, Swiss Franc, and Japanese Yen are the major currencies most commonly traded. More than $4 trillion worth of transactions take place on the Forex market every day, making it the world's largest financial market.

A physical location or centralized exchange is not available for Forex. Trading takes place all around the world, no matter what time it is. The Forex market keeps ongoing as long as all the countries are involved. Other trades may take a break at times, but the Forex market never stops.

Speculating in the Forex market

In Forex, there are no physical locations or central exchanges. Trading takes place all around the world, no matter what time it is. The Forex market keeps ongoing as long as all the countries are involved. Other trades may take a break at times, but the Forex market never stops.

Over time, the Forex market became more accessible and now exporters, importers, speculators, long-term investors, day traders, international portfolio managers, and multinational corporations are all free to trade it.

One important factor to consider is that financial and commercial transactions make up most of the trading volume, usually based on speculation.

Simply put, most trading volumes come from traders executing trades based on price movements happening throughout the day. The trading volumes are dominated by speculators to the tune of 90%.

The Forex speculative market scale results in high liquidity, which is the amount of trading volume that happens in a given period. Thus, the buying and selling of currencies have become a very convenient activity for almost everyone.

The forex market is characterized by substantial price movements, and liquidity is a significant determinant of these movements. With high liquidity, even the smallest price changes can trigger trading opportunities. The reason why there are so many transactions in a short period is that this is where most traders make their profits.

Especially in a market with relatively high liquidity, the market depths can change over time and depend on the currency pair.

There are rules of earning on the Forex market as well. To be successful in the stock market, you have to buy low and sell high. This is the first rule you need to follow. There is a simple rule in forex trading that traders seem to ignore, resulting in massive losses. It is important to understand when it is the best time to purchase or sell currency. Trading decisions can be greatly aided by graphs for traders.

It will be essential for you to keep up with the trends and strategies that are announced every day in the news. To predict price movements, you should look at previous performance and previous activity. An economy's health is the main factor affecting the value of a country's currency.

You should be aware of everything that happens around the world, especially if it could affect the value of currencies. For the Forex market to be friendly, you cannot treat it as a guessing game; what you do and what you expect should be clear.

We will cover all the necessary educational information you need in order to become successful as a trader in our trading education section.

Advantages of the Forex Market

There are many benefits to forex trading, and here are some of the reasons why it is becoming more popular by the day.

No Fees

You will not be charged brokerage fees, government fees, clearing fees, or exchange fees. A quote-ask spread is what retail brokers in this market use to calculate their compensation.

No Middlemen

Due to the elimination of middlemen, spot currency trading allows you to trade directly with the market price of particular currency pairs.

No fixed lot size

In the futures market, contracts and lots are determined by exchanges. For example, silver futures have a contract size of 5000 ounces. In spot Forex, you can choose the size of your position. Due to this, even a trader with a capital of $25 can enter the market.

Low cost of the transaction

Under normal market conditions, the transaction cost would be less than 0.1%. The spread on large transactions is typically around 0.07 percent. It depends on your level of leverage, however.

An around the clock market

Waiting for the bell is unnecessary. Throughout the day in the forex market, from the morning opening in Australia to the afternoon close in New York, no sleep is ever taken. Part-time traders can trade at times that are convenient for them because this allows them to choose the time they want to trade. This can happen in the morning, at noon, over breakfast, while sleeping, or during the night. Forex offers unlimited possibilities.

The market cannot be cornered

Since Forex trading is such a large market with many participants, it is impossible for anyone individual or entity to control the direction of prices for any given time period.

High Leverage

With leverage in the Forex market, a small deposit can be used to control a large contract value. A trader can make substantial profits using leverage by keeping risk capital at a low level.

The trader will be able to purchase and sell currencies worth $3000 with a $100 margin deposit if the broker provides 30-to-1 leverage. A $100 margin deposit would enable $1000 traders to buy and sell $3000. There are as many advantages as there are disadvantages in this aspect of the Forex market. A small amount of money can be lost in a short amount of time without proper risk management.

High Liquidity

There is a lot of liquidity in the Forex market because it is quite large. It is possible to trade at any time in the Forex market, as there is always somebody ready to trade with you at the other end of the line. Every trade has its own peaks and troughs. Additionally, you can create a trading platform that will automatically trade on your behalf depending on the profit level you specify. If your trade goes against you, they will automatically close it for you.

Low Starting Capital

To get started on the Forex market, most people believe it will take tons of money. As compared to other trades, such as futures, options, or stocks, it doesn't have much of an impact. You can open an account with online Forex brokers for as little as $25 and start trading right away.

Opening an account with the minimum amount does not necessarily mean that you should deposit the minimum amount. Just for convenience sake, we want to make the Forex market accessible to everyone. The capital you need for a decent return will have to be invested a little bit more.

Free stuff everywhere

Various online Forex brokers provide demo accounts. As a result, you can build your skills and learn the trade in order to be prepared for the real market. It's free to open up a demo account!

Beginners who are just entering the Forex market would benefit from these accounts since they will be able to sharpen their knowledge before investing any money in live accounts.

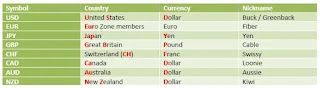

Currency Symbols

Learning the currency symbols is the first step in learning Forex. These symbols can be found in all parts of your trading platform, charts, and Forex analysis.

You will be able to recognize currency symbols at a glance once you have completed this course.

Currency symbols always consist of three letters, with the first two identifying the country and the third identifying the currency of that country.

Take USD for instance. US stands for the United States, while D stands for the dollar. Easy enough, right?

CAD is also easy to remember; CA stands for Canada and the famous D stands for dollar. The result would be Canadian Dollars!

CHF may be harder to remember. Switzerland is officially known as the Swiss Confederation (Confoederatio Helvetica in Latin) which is abbreviated CH! Just like the internet domain names that end with “.ch”. You add the Franc to that and you’ll have CHF!

The currencies included in the table above are called the "MAJORS" because they are the most traded ones.

Over 90% of all currencies are traded against the US Dollar (USD). The next most-traded currencies are the Euro (EUR), Japanese Yen (JPY), Pound Sterling (GBP), and Swiss Franc (CHF).

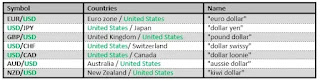

Currencies Are Traded in Pairs

When you buy a laptop from a vendor, you have to offer him the equivalent value of this particular laptop in cash. Forex works the same way. You cannot buy a currency without “offering” something else that has the same value.

This is the reason why Forex is traded in pairs. You cannot just buy the Euro without offering another currency for the person that is selling you this money. You can offer him US Dollars, Canadian Dollars or any other currency. Basically, if you want to buy Euros and offer the seller US Dollars, you simply buy the currency pair: EUR/USD.

When you buy EUR/USD, you are basically buying Euros and selling US Dollars simultaneously. This system will avoid you to sell your US Dollars then waiting to buy the Euros you want.

In other words, buying EUR/USD means that you are exchanging your “virtual” US Dollars for Euros.

Your first question may be whether you will always be able to find a counterparty who will sell you what you want and buy from you the exact amount of currency you are offering. Forex is a market that deals with trillions of dollars worth of currency every day, as we mentioned in the previous chapter. As a comparison to the Stock market, one of the biggest advantages of Forex is that there is ALWAYS a counterparty buyer or seller. That is your broker's job, so you don't need to worry about it. The Forex broker you choose should be able to locate someone willing to buy your products and sell you the exact equivalent currency you want in a fraction of a second!

Understanding a Forex Quote

Quotes represent the actual price of a security at that moment (in our case, a currency pair).

What Does “Pip” Mean?

A “pip” is the smallest price change that a given exchange rate can make. The smallest change is the last decimal point since most currency pairs are priced to four decimal places.

In our above example, Euro is quoted at 1.4491. If it moves to 1.4492, that means that it went up 1 pip. On the other hand, if it moves to 1.4490, then it fell 1pip.

When Euro is priced at 1.4991/1.4994, then the spread is 3 pips!

Leverage

Leverage is the mechanism by which a trader can control a market position much larger than the initial investment. stocks enable you to take positions up to 100 times the value of the initial investment. However, some recommend that your open positions not exceed more than 10 times your total account value at any one time. Solely you are responsible for the risks you take and the consequences of those risks, positive or negative.

Leverage can cause large gains as well as large losses quickly, even when conditions are relatively calm.

When the maximum permissible leverage is exceeded (for example, when account equity falls due to trading losses).

Technical Analysis

Analyzing market data and figures, then predicting market trends, is the definition of technical analysis. This was not done publicly before the internet. The public did not have access to the data as it is today.

Nearly every household is connected to the internet today. Anybody can perform technical analyses now. It is now possible for anyone to access complex technical indicators, analysis, and charts that were previously only accessible to a select few, and often for free as well. Short-term predictive excellence makes it an excellent instrument for short-term trading, such as on the Forex market.

Technology has become popular, and it is now important to inform people about what it is all about and how they can benefit from it. Most beginners fail at technical analysis largely because of a lack of basic knowledge which would otherwise allow them to interpret and understand technical indicators.